Market Analysis

Bloomberg Technoz, Jakarta - Harga emas dunia naik pada perdagangan kemarin. Harga sang logam mulia berhasil bangkit setelah anjlok lumayan dalam.

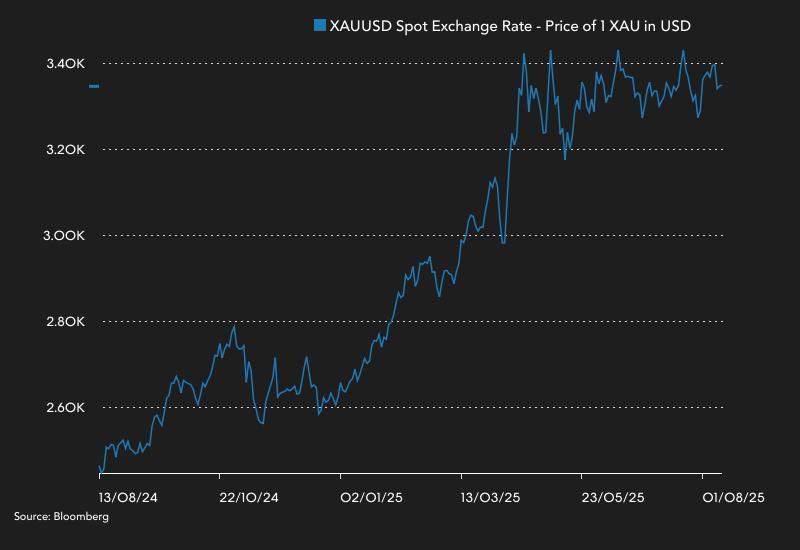

Pada Selasa (12/8/2025), harga emas dunia di pasar spot ditutup di US$ 3.351,7/troy ons. Menguat 0,26% dibandingkan hari sebelumnya.

Kala perdagangan awal pekan, harga emas ambruk lebih dari 1%. Jadi sepertinya aksi bargain buying menjadi salah satu penyebab kenaikan harga aset ini.

Selain aksi ‘serok di bawah’. kenaikan harga emas juga rasanya disebabkan oleh rilis data terbaru di Amerika Serikat (AS). Malam tadi waktu Indonesia, US Bureau of Labor Statistics melaporkan inflasi Negeri Paman Sam pada Juli berada di 2,7% secara tahunan (year-on-year/yoy). Sama seperti bulan sebelumnya dan berada di bawah ekspektasi pasar dengan perkiraan 2,8% yoy.

Secara bulanan (month-to-month/mtm), inflasi Juli ada di 0,2%. Di bawah realisasi Juni yang sebesar 0,3%.

Meanwhile, core inflation in July was 3.1% year-on-year, higher than June's 2.9% year-on-year and the highest in the past five months.

Core inflation was 0.3% month-on-month (mtm), higher than June's 0.2% mtm and the highest in the past six months.

Although core inflation has accelerated, headline inflation has slowed. This could be a reason for the Federal Reserve to lower its benchmark interest rate.

Citing CME FedWatch, the probability of a 25 basis point (bps) cut in the Federal Funds Rate to 4-4.25% at the September meeting reached 93.4%.

Gold is a non-yielding asset . Holding gold becomes more profitable when interest rates fall.

Technical Analysis

So, what's the gold price prediction for today? Will it rise again, or will it see a correction?

Technically, using a daily timeframe , gold remains stuck in a bearish zone . This is evident from the Relative Strength Index (RSI) of 49.

An RSI below 50 indicates an asset is in a bearish position . However, gold's RSI hasn't fallen significantly below 50, so it can be considered neutral.

Then the Stochastic RSI indicator is at 53. It is in the buy ( long ) area but is not yet strong, still heading towards neutral.

For today's trading, gold prices still have the potential to rise further. The nearest resistance target is US$3,359 per troy ounce. If it is broken, the next target will be in the range of US$3,366-3,377 per troy ounce.

Meanwhile, the nearest support target is US$ 3,339/troy ounce. A break at this point risks dragging the gold price towards US$ 3,322-3,311/troy ounce.